How Will Integrated Car-Cameras Change Vehicle and Fleet Insurance?

Read more

Turn all Your Insured Vehicles into Rich Data Generating Machines

Refine your Book of Business by promoting safe driving with context-aware driver coaching and ranking. Reduce loss ratio, prevent fraud and streamline claim adjustment.

Want to Know More?Drivers Love Nexar Cameras

Nexar cameras are used globally by hundreds of thousands of drivers, from Consumers and Families, through Owner Operator and Rideshare drivers, to Large Fleets. They offer an easy to install and user-friendly experience, ensuring a seamless journey for your policyholders.

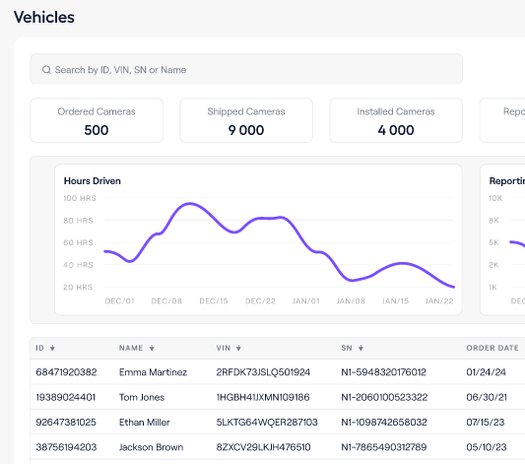

Easy Setup of Your Insurance Camera Program

Nexar's Insurance Platform streamlines the setup of your Insurance Program, offering easy access via Portal or APIs. The platform consolidates all the crucial policy and camera information for easy management, enabling instant assessment of policy compliance, transfer of camera coverage when replacing vehicles, and straightforward policy cancellations.

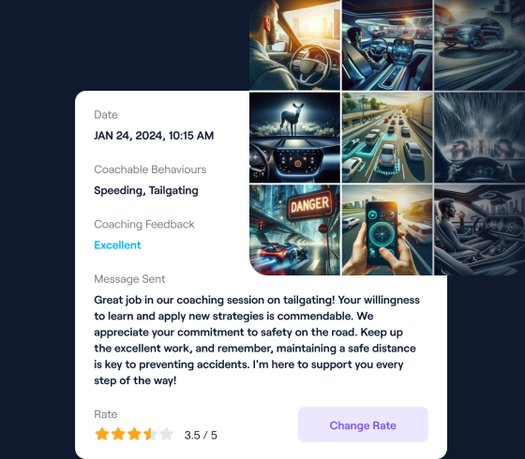

Unlocking a New World of Risk Management and Coaching Powered by Vision-AI Telematics

Nexar AI-powered dash cams continuously see the entire driver journey, allowing to capture all the relevant context, and correctly intercept the impact of driving actions, driver behavior and road conditions. You can then benefit from precise and quick risk analysis, promoting safer driving practices, and rewarding responsible drivers.

Traditional Telematics

“Hard Brake Detected”

Vision Telematics

“Hard Brake Detected. The driver was tailgating. The driver was using his phone. The weather was sunny”

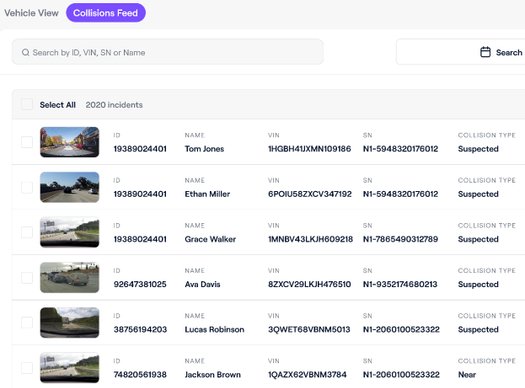

Reduce Claim Ambiguity & Loss Adjustment Expense

Nexar's Insurance Platform enables you to set a new standard in claims management, allowing to settle claims in a quick, automated and cost effective manner with one source of truth, translating into satisfied customers and reduced operational expenses.

Nexar dash cams store up to 3 months of non-stop video recording, ensuring crucial evidence is at your hand for any claim, even fraudulent ones.

Nexar dash cams catch 2-3x more true incidents than standard IMU-based systems.

Nexar leads the industry in on-demand video retrieval from fully connected cameras (success rate of ~97%), far surpassing SD card solutions (~25%).

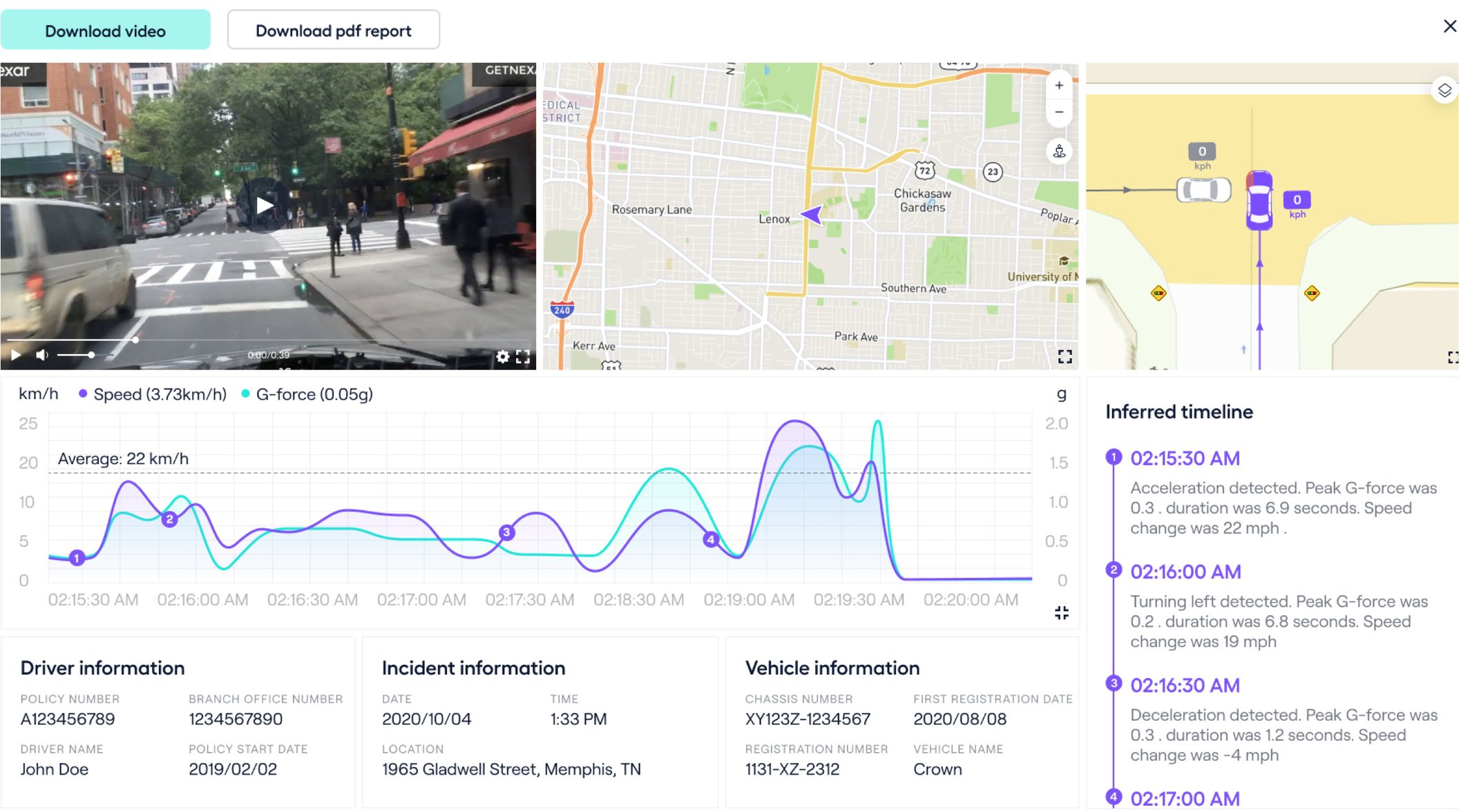

Supporting one-click reports, a video FNOL, with all information localized and in-context.

A second-by-second timeline reconstruction with driver behavior (e.g. speed, distance and braking data) and a detailed status of signs and traffic lights

A detailed collision timeline that includes 3rd party behaviour, (e.g. speed and location), automatically providing full sensor and visual verification of what actually happened between colliding vehicles.

Great for small fleets

Nexar's dash cams can be a cost effective way to provide value to insured fleets and professional drivers, from ride-share to drivers. Your insured fleets and drivers will get a smart dash cam that can help them exonerate drivers and prove the truth, even with regards to what is happening inside the cab. They will also be able to track vehicles and coach drivers. You can offer a discounted program and better manage claims with visual evidence and collision reconstruction.

Read more

Works for existing dash cam programs

Our detection, damage assessment and reconstruction capabilities can cover any connected camera, enabling collision reconstruction for all insurers with a connected camera program. You can aggregate and search across all videos using your driver metadata, without download, IT or storage issues, reduce the time to determine cause of collision, insure liability and validate the intake call using data from the dash cam (accident location, impact direction, vehicle speeds and more). Nexar’s platform can also be seamlessly incorporated into your FNOL and adjustment processes.

Vision-AI Telematics by Nexar for Successful Insurance Outcomes

Want to Know More?